In a market where interest rates were rising significantly, there is now an observable trend that the five and ten-year interest rates have stabilized at a lower level. According to Daan Reekers of debt broker Adelaer, this means that it can now be advantageous to fix the interest rate for a longer period.

The reason it can be advantageous to fix the interest rate for a longer period is due to an inverse interest rate policy, where there is currently a 1.5 percent difference between the three-month Euribor (variable interest) and the five-year fixed IRS (capital market interest) based rate.

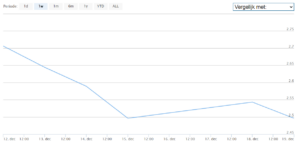

5-year interest rate, last week:

Daan Reekers: ‘The five-year IRS interest rate has now dropped below 2.5 percent. Banks purchase this five-year IRS interest rate for approximately 1.5 percent lower than the variable interest rate. On a loan of five million euros, this directly saves 75,000 euros per year in interest. While interest rates are not predictable, if the lower interest rate remains stable for an extended period, it often indicates that a significant reduction in interest rates is not expected in the short term. The general predictions for Euribor rates also suggest that they will decrease to the level in 2024.’

10-year interest rate, last week:

Rest

But not all banks immediately reflect this difference in their rate offerings. Reekers: ‘That’s precisely why it’s important to make a well-considered decision. Besides examining the interest rate, it’s crucial to scrutinize the level of the markup as well. Due to increased market competition, we observe significant differences in that aspect with some providers. Choosing the right financing can result in substantial savings. Moreover, the ten-year interest rate is now virtually at the level of the five-year interest rate. So why not opt for a longer fixed rate and secure certainty for an extended period? Variable interest rates are, after all, volatile, whereas fixing the interest rate brings about tranquility. Yes, I hear you thinking: but my current bank or provider doesn’t allow this… That’s precisely why a thorough comparison is essential.’

Euribor, 3-month interest rate, last week:

Prepayment penalty when refinancing

Unlocking home equity

It’s also easier to unlock any home equity with foreign financiers. Reekers: ‘We not only finance with banking partners that need to consider the bank’s risks and upcoming Basel 4 legislation. Especially with international pension or insurance funds, better and sharper rates with longer terms, ranging from seven to even more than ten years, are possible. There is much more possible than one might think, and the market is very dynamic.’

Quality Data Makes Better Deals

However, if investors and developers want to be bankable abroad, they need to have their data well under control. Foreign financiers are accustomed not only to working with cash flow models but especially with transparency in data. Reekers: ‘Due to our digital search engine with more than 2,200 providers, we know exactly what such parties require, and we can assist our clients with that. It’s about professionalism and being bankable for the debtor; now and in the future. The digitization of financial processes is becoming more important every day. Access to data and its quality matters more than ever. We live in a wide world with access to money. But as a real estate professional, you also need to have your finances in order professionally.’